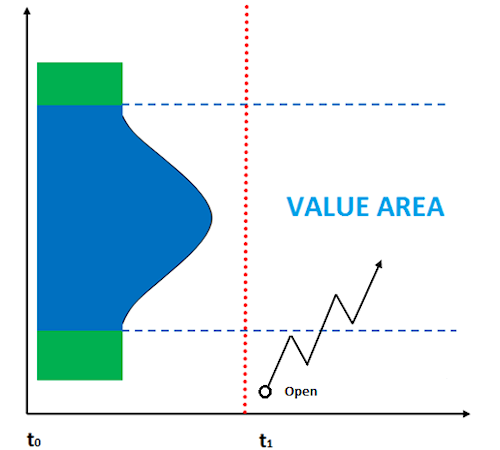

The Value Area represents the area where the greatest number of trades were concentrated (around 70% of volumes) in the period of time considered (usually a session). In other words, it identifies the price range of greatest interest to traders.

In the image below the Value Area is represented by the blue area. The price level drawn in red is the POC (Point Of Control) which represents the price level with the greatest number of volumes traded within the Value Area.

Let’s see some of the most common market situations:

Initial Activity

The market opens above (or below) the previous day Value Area and prices continue to remain outside this. If it opens above, a bullish movement can most likely be expected. If it opens below, a bearish movement can most likely be expected.

Initial Buying

If the market opens and remains above VA, we are in the presence of a probable bullish signal and upward movements should not be interpreted as possible short entries.

Initial Selling

If the market opens and remains below VA, we are in the presence of a probable bearish signal and downward movements should not be interpreted as possible long entries.

Reactive Buying

Two possible scenarios:

- The market opens within previous day VA, then moves to VAL level (VA low), goes beyond it and stays below it. At this point important buy orders enter the market and bring prices back within VA.

- The market opens below VA and traders immediately enter the market to buy. In other words, prices move upwards starting from the open. A first target level is VAL level (VA low) of previous day.

Reactive Selling

Two possible scenarios:

- The market opens within previous day VA, then moves to VAH level (VA high), goes beyond it and stays above it. At this point important sell orders enter the market and bring prices back within VA.

- The market opens above VA and traders immediately enter the market to sell. In other words, prices move downwards starting from the open. A first target level is VAH level (VA high) of previous day.

Balanced Market

A market is balanced when it trades within VA. Buyers and Sellers are equally present and trade at prices that they both consider balanced. Prices still move up and down, but when they reach the high or low VA levels (VAH and VAL) they are rejected.

Unbalanced Market

A market is not balanced when trading outside VA. In other words, when opens outside VA and stays outside. We are in the presence of a market that is most likely looking for a new equilibrium on higher/lower prices.

Common Scenarios #

One of the most common uses of VA is to relate current trading activity to the area defined by previous day or by a series of previous days taken as reference.

The term open usually refers to the OPEN price of RTH session. For example, for ES futures instrument (S&P 500), the open price of RTH session is the 8:30 AM (Chicago Time) price.

Here are some very common scenarios:

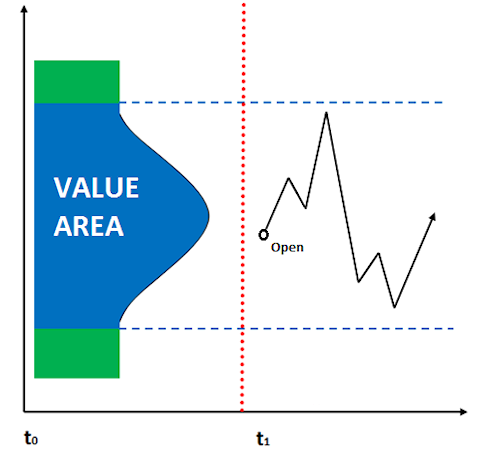

Scenario 1 – Unbalanced market #

The market opens above previous day’s VA and remains above it after testing VAH (VA high) level. In this situation the resulting signal is a continuation of the bullish trend.

In the event that the market, after testing VAH level, returned and remained within previous day VA range with increasing volumes, the signal would be that of a probable lateral trading range.

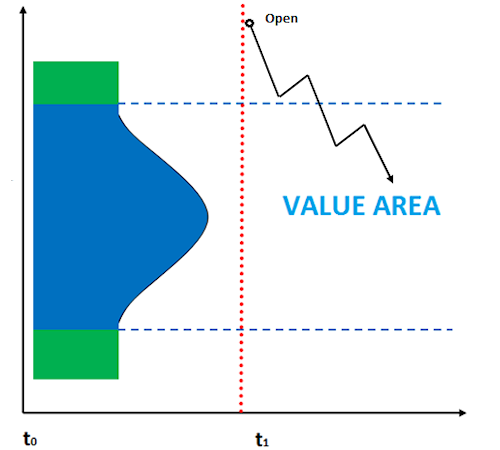

Scenario 2 – Unbalanced market #

The market opens below previous day’s VA and remains below it after testing VAL (VA low) level. In this situation the resulting signal is a continuation of the bearish trend.

In the event that the market, after testing VAL level, returned and remained within previous day VA range with increasing volumes, the signal would be that of a probable lateral trading range.

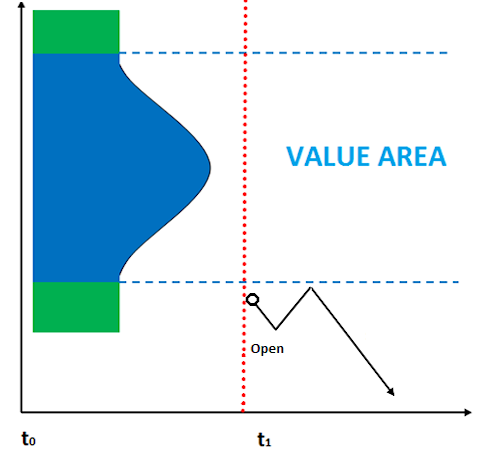

Scenario 3 – Reactive Selling #

The market opens above previous day’s VA, but prices fall back into VA almost immediately. Prices will most likely tend to remain confined within VA and will probably try to test the VAL level (VA low).

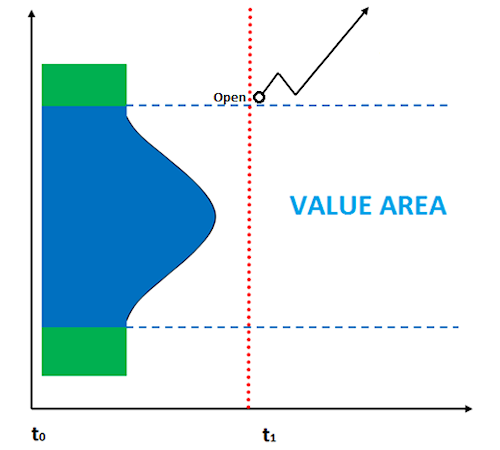

Scenario 4 – Reactive Buying #

The market opens below previous day’s VA, but prices rise back into VA almost immediately. Prices will most likely tend to remain confined within VA and will probably try to test the VAH level (VA high).

Scenario 5 – Balanced market #

The market opens within previous day’s VA and prices remain within it. Prices will most likely tend to remain within VA even in the subsequent phases of the day, testing VAL and VAH values one or more times.