Volume Profile can have different forms depending on volume distribution over the reference time frame. Below are the most important distribution types.

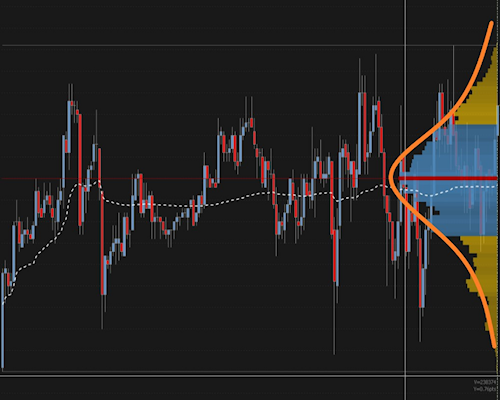

Normal distribution #

This is the Volume Profile classic shape, a Gaussian. VPOC (red horizontal bar) is positioned in the center of profile and Value Area is equally distributed below and above VPOC.

Double-shaped distribution #

Profile shape is double humped, with the presence of a secondary VPOC as important as the main VPOC.

Triple-shaped distribution #

Profile shape is triple humped and the three humps are very similar to each other. This means that the market stood at three different price levels trading similar volumes. In addition to the main VPOC, peaks of secondary humps must also be considered.

Multiple distributions #

Profile does NOT have a well-defined shape and has several peaks (like a fork). This distribution type highlights a market without a particular balance.

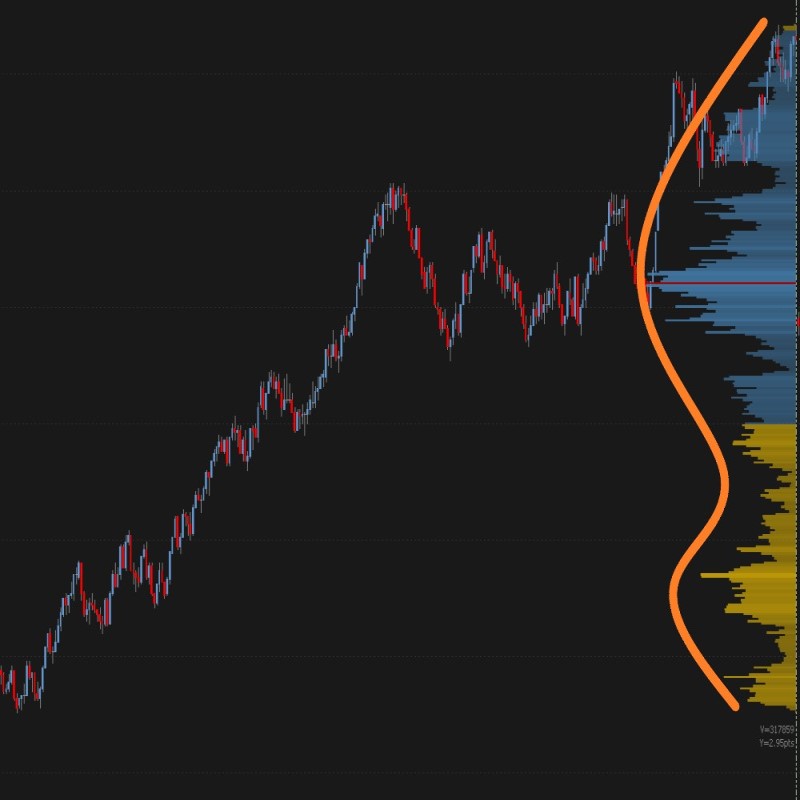

‘P’-Shaped distribution #

Profile shape is a ‘P’ (or a ‘q’ if profile is drawn from right to left). In the image below, VPOC and Value Area are positioned at the top, highlighting a balance of volumes at highs.

‘d’-Shaped distribution #

Profile shape is a ‘d’ (or a ‘b’ if profile is drawn from left to right). In the image below, VPOC and Value Area are positioned at the bottom, highlighting a balance of volumes at lows.

Long distribution #

In this distribution type the profile is wider than average. Three possible forms:

‘d’ extended #

Profile has a long ‘d’-shape. It highlights a balanced market on the lower end, but with significant upward extension.

‘P’ extended #

Profile has a long ‘P’-shape. It highlights a balanced market on the higher end, but with significant downward extension.

Not balanced #

Profile shape highlights a market looking for a new balance. VPOC is not particularly pointy and the profile is wider than average.